flow through entity taxation

Instead the income passes to the owners of the business who pays personal. Effective January 1 2021 the Michigan flow-through entity FTE tax is levied on certain electing entities with business activity in Michigan.

Pass Through Entity Tax Annual Filing Demonstration Youtube

A trust maintained primarily for the benefit of.

. Flow-through entities can generally make the election for tax year 2021 by specifying a payment for the 2021 tax year that includes the combined amount of any unpaid quarterly estimated. This means that the flow-through entity is responsible. As a result only the individuals not the business are taxed.

Flow-through entities are considered to be pass-through entities. 2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest. Instead their owners include their allocated shares of profits in.

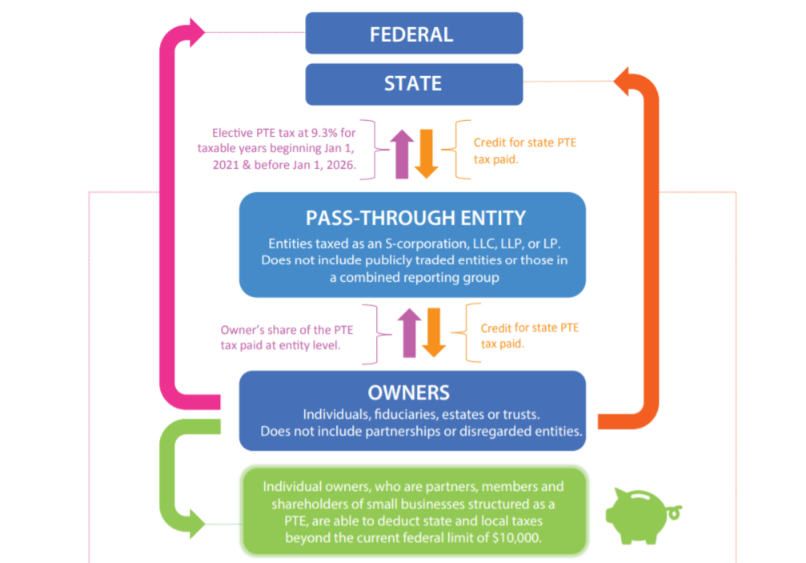

Log on to Michigan Treasury Online MTO to update. That is the income of the entity is treated as the income of the investors or owners. A flow-through entity FTE is a legal entity where income flows through to investors or owners.

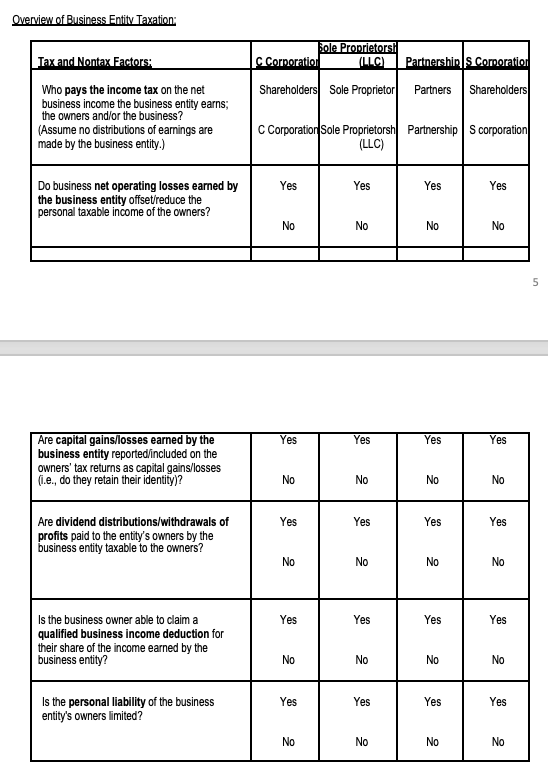

Limited liability companies partnerships and subchapter S corporations have so-called flow through taxation That means that the entity files a tax return but the taxes are. Types of Pass-Through Entities. A flow-through entity is a business in which income is passed straight to its shareholders owners or investors.

Is elected and levied on the Michigan portion of the. Because of the increasing use of such flow through entities for a variety of business issues at the state level continue to assume even greater prominence. However the late filing of 2021 FTE returns will be.

Flow-Through Entity Tax - Ask A Question. Many businesses are taxed as flow-through entities that unlike C corporations are not subject to the corporate income tax. Flow-through entities are different from C corporations they are subjected to single taxation and not double taxation.

This disconnect between receipt of cash and. My recent article critically analysed. For further questions please contact the Business Taxes Division.

The entitys income only goes through a. Flow-through entity income is reported by the entitys principals and tax paid on it regardless of whether any cash is distributed. The range of features that comprise each method of taxation entity taxation and flow-through taxation are set out in previous work see here and here.

A flow-through entity is also called a pass-through entity. Understanding What a Flow-Through Entity Is. Pass-through taxation refers to businesses that do not pay taxes on the entity level.

This guidance is expected to be published in early January 2022 and will be posted to the Departments website. You are a member of or investor in a flow-through entity if you own shares or units of or an interest in one of the following. Advantages of a Flow-Through Entity.

There are two major reasons why owners choose a flow-through entity. With sole proprietorships LLCs partnerships and S corporations business income flows through to the business owners and is taxed only at the individual.

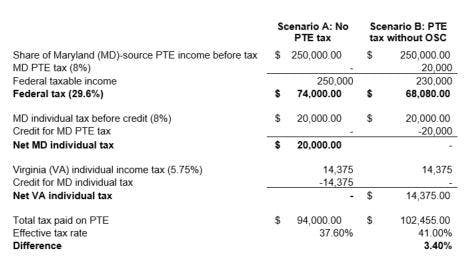

Pass Through Entity Level Tax Is This A Viable Salt Cap Workaround Blue Co Llc

What Are Pass Through Businesses Tax Policy Center

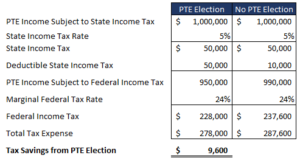

Salt Limitation And The New York State Pass Through Entity Tax Ptet By Adam E Panek Cpa Partner Grossman St Amour Cpas Pllc

State Taxation Of Pass Through Entities Recent Nexus Developments Salt Cap Pass Through Entity Workarounds Taxops

Pass Through Entity Tax Information Zulch Tax Consultants

The California Elective Pass Through Entity Tax Provides Business Owners A Salt Cap Tax Credit Workaround

Ab 150 Passthrough Entity Elective Tax Devereaux Kuhner Co Llp

California Enacts Changes To Elective Pass Through Entity Tax Hcvt State Local Tax Holthouse Carlin Van Trigt Llp

Georgia S Pass Through Entity Tax Election Offers Salt Cap Workaround Mauldin Jenkins

Michigan Moves Quickly To Implement Pass Through Entity Tax For 2021

Flow Through Entity Example Chantelle Larry Chegg Com

Update New Pass Through Entity Tax Information Windes

Nj Salt Work Around Pass Through Entity Tax

The Pass Through Entity Tax Ptet Now Applies To New York State Here S What You Need To Know Wiss Company Llp

Michigan Pass Through Entity Tax Enacted What You Need To Know For 2021 And 2022 Fmd

Pass Through Entity Definition And Types To Know Quickbooks

Sole Proprietorships And Flow Through Entities Ppt Download

Pass Through Entity Tax 101 Baker Tilly

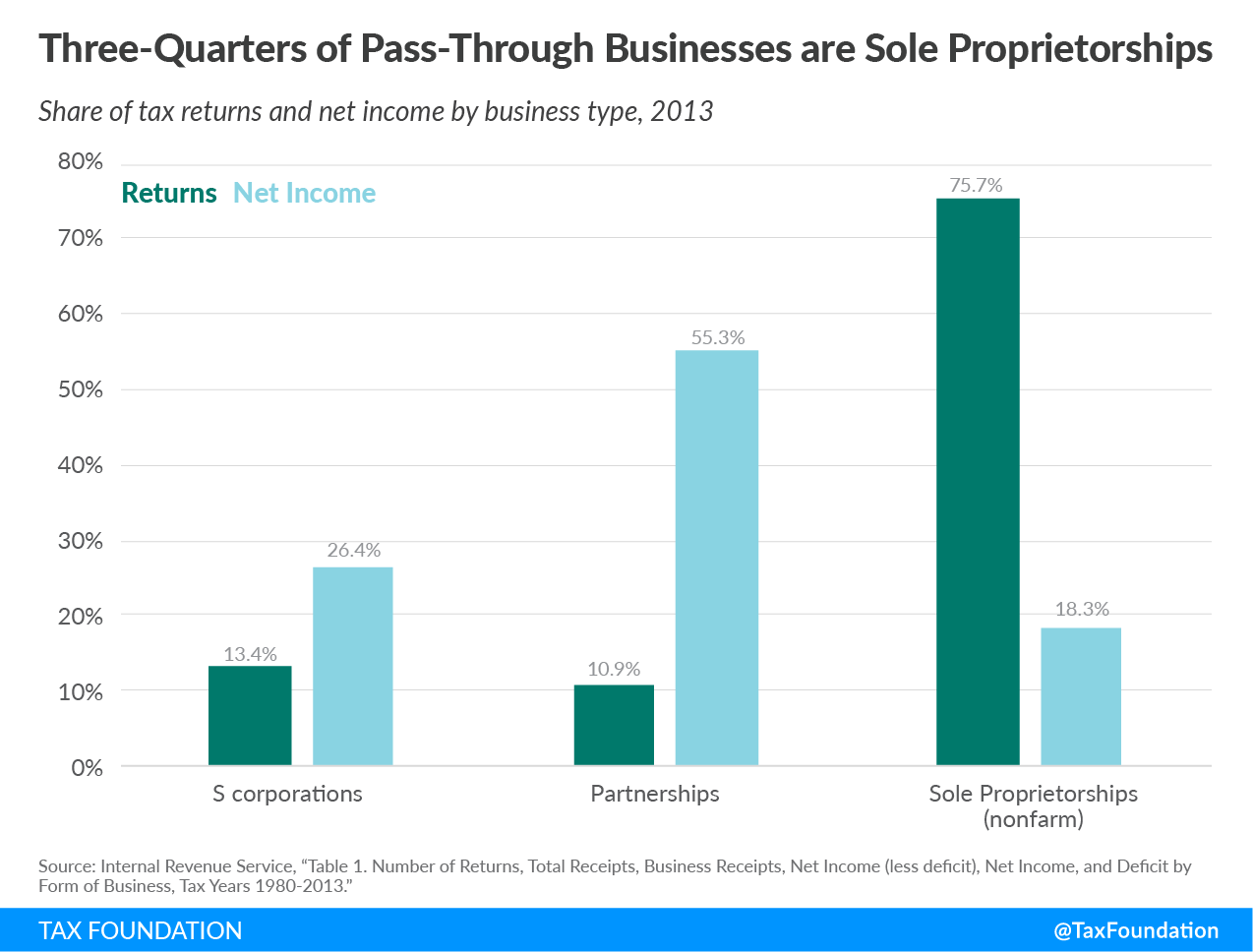

What Is A Pass Through Business How Is It Taxed Tax Foundation